All Categories

Featured

Table of Contents

- – Dependable Accredited Investor High Return Inv...

- – Accredited Investor Growth Opportunities

- – Acclaimed Accredited Investor Growth Opportun...

- – Advanced Accredited Investor Financial Growth...

- – Reputable Exclusive Deals For Accredited Inv...

- – Trusted Passive Income For Accredited Invest...

- – Expert Accredited Investor Growth Opportunit...

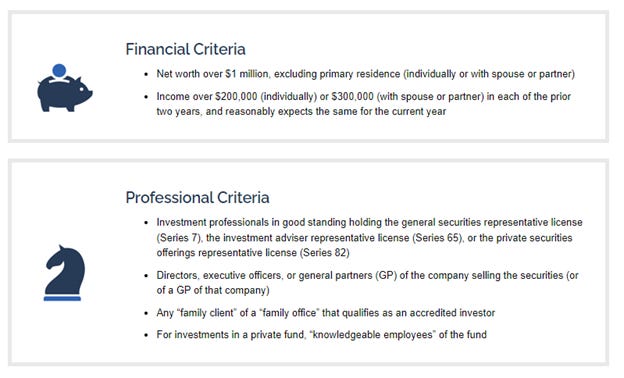

The laws for certified capitalists differ amongst jurisdictions. In the U.S, the interpretation of a certified financier is placed forth by the SEC in Policy 501 of Guideline D. To be a certified investor, a person has to have a yearly income surpassing $200,000 ($300,000 for joint revenue) for the last two years with the expectation of making the very same or a greater earnings in the current year.

This quantity can not consist of a key residence., executive officers, or supervisors of a firm that is issuing non listed protections.

Dependable Accredited Investor High Return Investments for Accredited Investor Wealth Building

Additionally, if an entity contains equity owners that are certified investors, the entity itself is a certified financier. An organization can not be developed with the single purpose of buying details protections. An individual can certify as a certified financier by demonstrating sufficient education and learning or job experience in the financial market

People who intend to be recognized capitalists do not relate to the SEC for the classification. Rather, it is the duty of the business supplying an exclusive placement to see to it that every one of those approached are approved capitalists. Individuals or events who intend to be accredited financiers can come close to the issuer of the unregistered safety and securities.

For instance, suppose there is an individual whose revenue was $150,000 for the last 3 years. They reported a main residence value of $1 million (with a home mortgage of $200,000), a vehicle worth $100,000 (with an exceptional lending of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

Total assets is determined as assets minus responsibilities. This person's total assets is precisely $1 million. This includes a calculation of their assets (aside from their primary house) of $1,050,000 ($100,000 + $500,000 + $450,000) less a vehicle loan amounting to $50,000. Because they meet the total assets demand, they qualify to be a certified financier.

Accredited Investor Growth Opportunities

There are a couple of much less common qualifications, such as managing a count on with even more than $5 million in possessions. Under government securities laws, only those who are approved capitalists may join specific securities offerings. These may consist of shares in private positionings, structured items, and private equity or hedge funds, amongst others.

The regulatory authorities wish to be particular that participants in these highly high-risk and intricate financial investments can take care of themselves and evaluate the threats in the lack of federal government protection. The certified financier policies are designed to secure possible financiers with restricted financial knowledge from dangerous endeavors and losses they may be unwell equipped to hold up against.

Recognized capitalists meet qualifications and expert criteria to gain access to unique financial investment opportunities. Approved investors should meet income and internet well worth needs, unlike non-accredited people, and can invest without restrictions.

Acclaimed Accredited Investor Growth Opportunities

Some key adjustments made in 2020 by the SEC consist of:. Consisting of the Collection 7 Series 65, and Series 82 licenses or various other credentials that reveal economic experience. This change recognizes that these entity types are usually used for making financial investments. This adjustment recognizes the experience that these staff members develop.

These amendments increase the accredited investor swimming pool by about 64 million Americans. This bigger gain access to provides extra possibilities for financiers, but likewise boosts possible threats as much less financially sophisticated, capitalists can get involved.

One major advantage is the possibility to buy positionings and hedge funds. These financial investment options are special to certified capitalists and establishments that qualify as an approved, per SEC regulations. Personal positionings enable firms to secure funds without browsing the IPO treatment and regulatory paperwork required for offerings. This gives certified investors the chance to buy emerging business at a stage before they consider going public.

Advanced Accredited Investor Financial Growth Opportunities

They are considered as financial investments and are easily accessible only, to certified customers. In enhancement to known business, qualified capitalists can pick to purchase startups and up-and-coming endeavors. This provides them income tax return and the opportunity to go into at an earlier phase and potentially reap benefits if the firm prospers.

However, for capitalists open to the threats entailed, backing startups can cause gains. A lot of today's technology business such as Facebook, Uber and Airbnb came from as early-stage startups supported by certified angel financiers. Innovative financiers have the possibility to discover investment options that may produce a lot more revenues than what public markets provide

Reputable Exclusive Deals For Accredited Investors

Although returns are not guaranteed, diversity and portfolio enhancement choices are expanded for investors. By diversifying their portfolios through these broadened investment methods accredited investors can enhance their techniques and possibly achieve superior long-term returns with appropriate danger administration. Experienced capitalists frequently run into financial investment alternatives that may not be quickly offered to the basic investor.

Investment alternatives and protections supplied to certified capitalists usually involve higher dangers. As an example, personal equity, equity capital and hedge funds usually focus on buying possessions that bring risk however can be sold off conveniently for the opportunity of higher returns on those risky investments. Looking into prior to spending is vital these in scenarios.

Lock up durations prevent investors from withdrawing funds for more months and years on end. Capitalists may have a hard time to accurately value exclusive possessions.

Trusted Passive Income For Accredited Investors for Secured Investments

This modification might prolong recognized financier condition to a range of individuals. Allowing companions in fully commited partnerships to combine their sources for common eligibility as certified capitalists.

Enabling individuals with specific expert qualifications, such as Collection 7 or CFA, to qualify as certified financiers. This would acknowledge financial refinement. Creating extra needs such as proof of monetary proficiency or effectively finishing a recognized capitalist exam. This can ensure investors recognize the dangers. Limiting or eliminating the key house from the net well worth calculation to minimize possibly inflated assessments of riches.

On the various other hand, it could likewise result in experienced financiers presuming extreme risks that may not be appropriate for them. Existing certified capitalists might deal with enhanced competition for the finest financial investment chances if the pool grows.

Expert Accredited Investor Growth Opportunities with Accredited Investor Support

Those who are currently thought about certified capitalists have to stay upgraded on any type of modifications to the criteria and guidelines. Organizations looking for accredited investors ought to remain vigilant about these updates to ensure they are bring in the appropriate audience of capitalists.

Table of Contents

- – Dependable Accredited Investor High Return Inv...

- – Accredited Investor Growth Opportunities

- – Acclaimed Accredited Investor Growth Opportun...

- – Advanced Accredited Investor Financial Growth...

- – Reputable Exclusive Deals For Accredited Inv...

- – Trusted Passive Income For Accredited Invest...

- – Expert Accredited Investor Growth Opportunit...

Latest Posts

Delinquent Property Tax

Is Tax Liens A Good Investment

Tax Lien Certificate Investments

More

Latest Posts

Delinquent Property Tax

Is Tax Liens A Good Investment

Tax Lien Certificate Investments