All Categories

Featured

Table of Contents

These would qualify as certified capitalists under various requirements in the definition. The SEC has a set of questions it sends frequently to figure out the status however I was unable to uncover if these results are released publicly. Estimates of the number of capitalists who are certified are normally put out by marketing research jobs or firms.

There is no limitation to just how lots of dollars a capitalist can purchase a Regulation D 506(c) offering. Yet there can certainly be limits enforced willingly by the financial investment itself. This is usually to stop any solitary financier holding a controlling rate of interest in the financial investment. Guideline D refers to Guideline D of the Securities Act of 1933 policy that regulates exclusive funds.

Guideline 506(c) enables companies to perform basic solicitation for their investments offered that all capitalists are certified investors at the time they pay right into the investment. You can confirm your recognized capitalist standing to the business using you safeties by giving a letter from your accountant, tax filing documents, pay stubs, financial institution declarations, financial statements, or any various other certification that shows you meet the required demands.

It is the task of the financial investment firm that is supplying you the safety and securities to identify your standing. They will allow you understand what they need, to verify satisfactorily to themselves that you meet the needs. Accredited investors have accessibility to possibly higher-yield financial investments yet this does not instantly guarantee them a higher return.

Personalized Venture Capital For Accredited Investors

These investment types are thought about high-risk, however HNWIs invest in them due to the fact that they do use such steady gains. The returns from alternate investments are commonly a lot greater than for Exchange Traded Finances (ETFs) or Shared Funds.

These returns are a few of the most effective in the market. Recognized investors have accessibility to a much larger array of financial investment possibilities to make cash. These include genuine estate submissions, hedge funds, private equity genuine estate, and more. Different financial investments supply several of the most adaptable kinds of financial investment approaches around since they do not require to adhere to policies so strictly.

Anyone who does not satisfy the certified capitalist standards is taken into consideration an unaccredited financier, or a non-accredited capitalist. That suggests the individual does not have either the total assets or the required understanding to be revealed to the potential danger offered in high-yield financial investments. The crowdfunding version is a fantastic opportunity for unaccredited investors because it has actually produced many possibilities for individuals who don't have the capital required to buy bigger jobs.

Accredited Investor Investment Funds

A Qualified Purchaser is somebody with a minimum of $5 million well worth of investments. Every qualified buyer is immediately additionally an accredited financier however every accredited investor is not always a qualified purchaser. Likewise, a recognized capitalist may have a total assets of over $5 million however not have all of it bound in financial investments (accredited investor syndication deals).

Financial Planning and Analysis (FP&A) is the practice of planning, budgeting, and examining an individual or organization's monetary standing to figure out the ideal possible method onward for their riches. FP&A is a specifically important task for certified financiers to ensure that their wide range does not devalue as an outcome of rising cost of living.

Not all advanced capitalists are certified. In particular offerings, advanced investors are allowed to take part, such as in 506(b) offerings, nonetheless, Wealthward Funding deals only in 506(c) offerings so all our investors need to be recognized.

Leading Accredited Investor Growth Opportunities

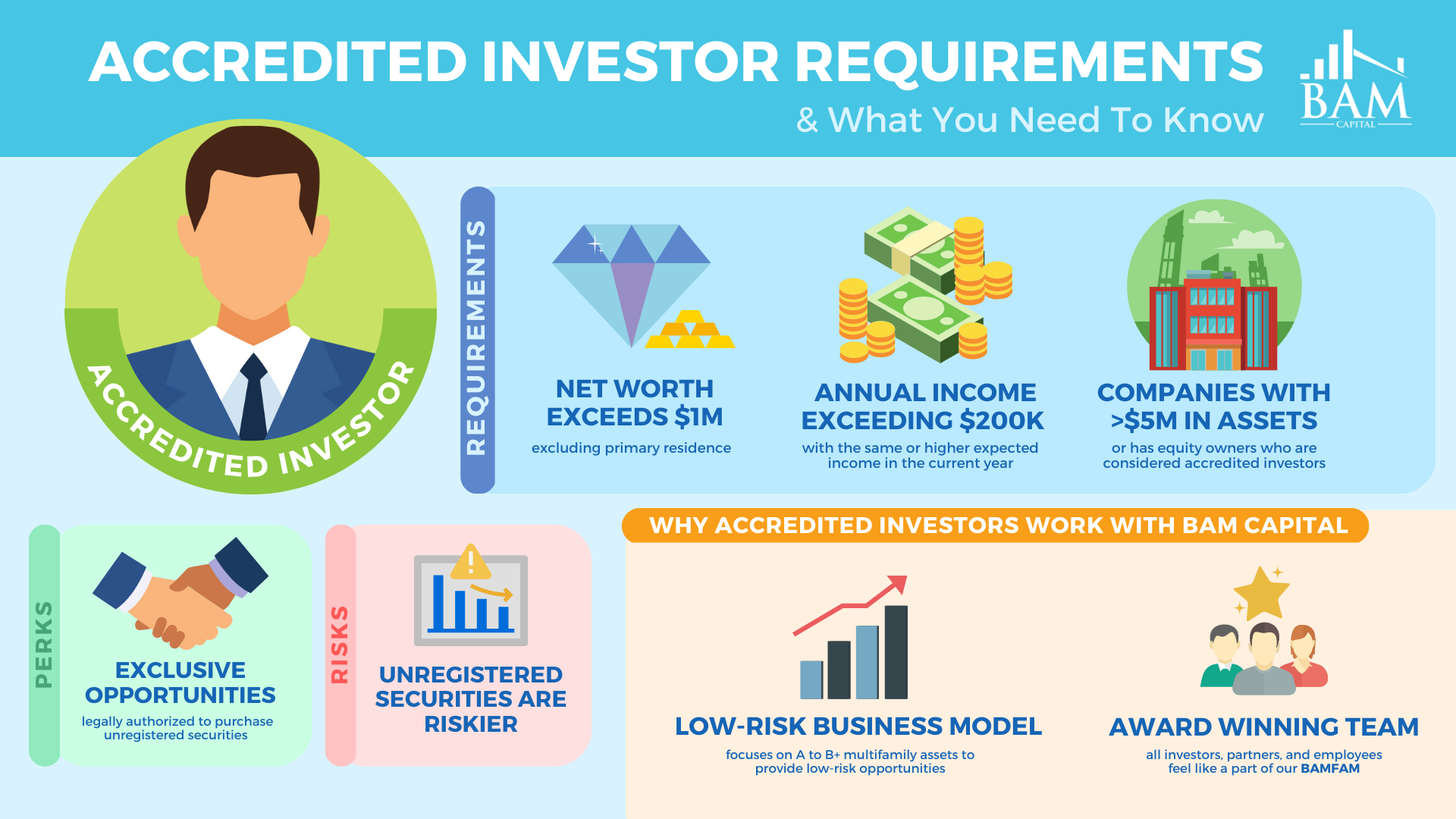

Some financial investment chances can be greatly controlled to secure investors and the issuers of securities. The United State Securities and Exchange Compensation (SEC) does not permit all capitalists to make every financial investment. Specific financial investments are limited only to recognized capitalists, which are people or entities that fulfill a list of strict qualifications.

Understanding just how to come to be a certified capitalist can aid you establish whether you qualify. The definition of an approved financier is a lawful entity or a person that is legally allowed to spend in financial investments that are not signed up with the SEC.

Tailored Exclusive Deals For Accredited Investors

Offerings signed up with the SEC has to publicly reveal details to investors and satisfy details demands from the SEC for securing investments. These investment opportunities include openly traded bonds, stocks, shared funds, and publicly traded actual estate investment depends on (REITs). Accredited financiers need to have the financial knowledge and experience to invest in offerings that don't give these defenses.

The requirements for qualifying as a recognized financier are in area to ensure these capitalists have the wherewithal to handle their finances and protect themselves from loss. The term certified capitalist is additionally used to explain capitalists who have the monetary capacity to absorb losses. The SEC's needs for certified investors are various for specific and institutional capitalists.

The financier should reasonably anticipate to maintain the very same earnings degree in the present year. Their web well worth can not include the value of their key home.

Accredited Investor Alternative Investment Deals

Policy 501 in addition offers demands for firms, organizations, trusts, and various other entities to certify as certified capitalists. An entity can certify as an accredited capitalist when it meets among the complying with requirements: The organization or exclusive service qualifies as a certified investor when it has even more than $5 million in assets.

An entity might certify as an approved investor if it has financial investments going beyond $5 million, was not created to obtain protections, and meets none of the various other needs for entities. If all of the entity's owners are approved capitalists, the entity can function as an accredited financier. The full checklist of criteria likewise consists of certain company kinds no matter overall assets or financial investments, consisting of: BanksInsurance companiesInvestment companiesCertain employee benefit plansBusiness growth business The accredited capitalist interpretation guarantees investors have the finances and experience to reasonably safeguard themselves from loss.

Business can offer safeties solely within one state without government registration. They should be incorporated in the state and might still require to satisfy state demands. Companies can market safeties to non-accredited capitalists using crowdfunding platforms under the JOBS Act. They do not need to register, companies still have to fulfill disclosure demands, and the quantity they can elevate is limited.

The certified financier classification safeguards investors. They additionally want to protect less experienced investors that do not have the understanding to recognize a financial investment's threats or the padding to take in losses.

Latest Posts

Delinquent Property Tax

Is Tax Liens A Good Investment

Tax Lien Certificate Investments